Performance Infrastructure in Enterprise Support

Optimized Systems in Enterprise Operations

Performance infrastructure is the heart of modern enterprise success. It creates a reliable structure that connects technology, teams, and workflows into one synchronized system. Every part of enterprise support depends on how well these systems perform. A strong foundation allows teams to maintain balance even during high workloads or rapid expansion.

Enterprises thrive when their internal systems work smoothly together. Information flows faster, communication barriers fade, and processes remain consistent. Structured infrastructure also prevents duplication and errors by centralizing functions that once operated independently. Through connected systems, companies save time, lower costs, and improve overall efficiency.

In competitive markets, adaptability determines survival. Scalable systems adjust to changing needs, whether through automation or resource reallocation. This ability to evolve without disruption defines true infrastructure performance. Enterprises that invest in optimized systems gain lasting control and measurable improvement across every department.

A well-developed performance infrastructure is more than a technical framework. It reflects a business philosophy centered on clarity, discipline, and precision. When systems are organized with intention, enterprises gain visibility and can react to challenges with confidence.

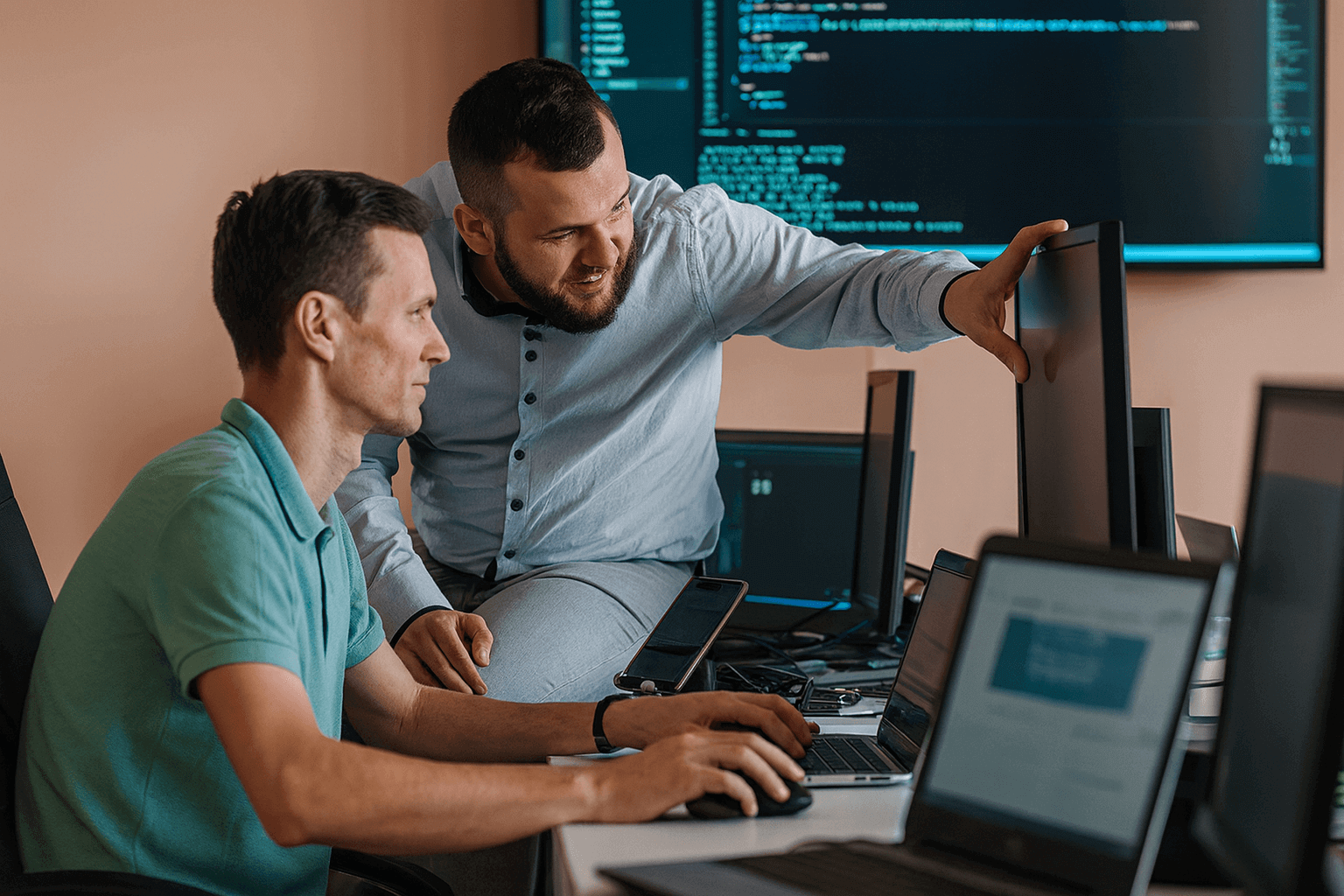

Advanced Integration in IT Development

Within modern enterprises, IT development serves as both the backbone and the brain. Every operation, data storage, security, and digital collaboration, relies on it. Advanced integration brings together applications, databases, and automated tools into one performance-driven environment.

Within modern enterprises, IT development serves as both the backbone and the brain. Every operation, data storage, security, and digital collaboration, relies on it. Advanced integration brings together applications, databases, and automated tools into one performance-driven environment.

With integration, teams work smarter. Developers can identify inefficiencies early, update processes, and maintain productivity without disrupting operations. This alignment increases agility, allowing faster adaptation to emerging technologies. Continuous testing ensures software reliability, while automation removes repetitive tasks, giving human talent more space for innovation.

Infrastructure performance in IT depends on speed and security. Enterprises must ensure stable connectivity, safe access, and redundancy planning. When systems remain operational during peak activity, they protect workflow continuity.

Strong integration also supports innovation. Through cloud computing and API connectivity, businesses introduce new features without replacing their existing systems. This flexibility is crucial for long-term growth. It enables companies to experiment, expand, and refine while maintaining stability.

Reliable infrastructure transforms IT development into a growth engine rather than a maintenance task. It ensures every upgrade enhances scalability and supports the goals of enterprise support.

Efficiency in Modern Debt Collection Systems

Financial operations demand precision, especially within debt collection systems. Modern infrastructure turns traditional processes into intelligent, automated mechanisms that deliver transparency and speed. Automation now manages communication schedules, account categorization, and data reporting.

Predictive analytics play an important role. Systems analyze patterns in repayment behavior, helping enterprises forecast outcomes and reduce overdue accounts. Machine learning refines communication strategies, making reminders more efficient and professional.

Security remains vital. Data protection safeguards client information and ensures compliance with regulations. Well-built infrastructure maintains encrypted channels for all financial interactions, reinforcing trust among customers and business partners.

By integrating automation, enterprises achieve consistency. Manual errors decrease, workflows simplify, and reporting becomes more accurate. The combination of technology and structured systems creates measurable results, faster payments, better compliance, and stronger client relationships.

Debt collection infrastructure is no longer about pressure. It is about performance and accountability. When systems align with ethical practices and clear communication, financial management becomes both productive and transparent.

Customer Experience in Service Optimization

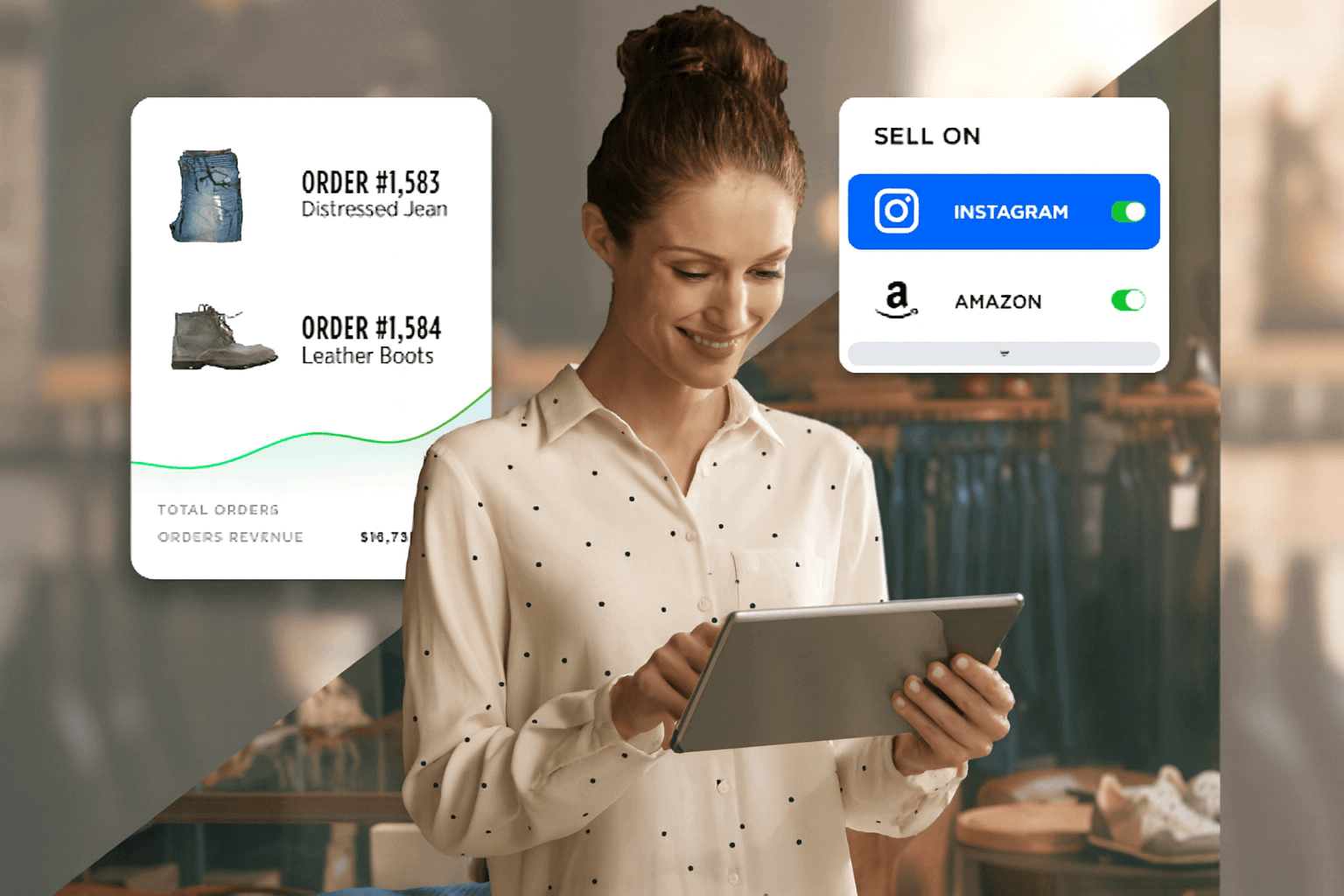

Every organization strives to improve customer service optimization. It is no longer enough to respond quickly; support must also be personalized and insightful. This transformation begins with a performance infrastructure that connects communication channels and integrates client data in real time.

Every organization strives to improve customer service optimization. It is no longer enough to respond quickly; support must also be personalized and insightful. This transformation begins with a performance infrastructure that connects communication channels and integrates client data in real time.

When systems share information instantly, customer agents gain full visibility. They can see past interactions, preferences, and purchase histories before responding. This helps resolve issues faster and builds a stronger connection with clients.

Infrastructure also influences tone and timing. With the right setup, automation prioritizes tickets, routes calls efficiently, and maintains balanced workloads among agents. These systems ensure that customers never feel ignored or delayed.

Data-driven insights strengthen optimization further. Enterprises analyze service trends to discover improvement points and identify new opportunities. This cycle of refinement keeps customer satisfaction high.

A reliable infrastructure creates a consistent experience. Whether a client contacts a company through chat, email, or voice, they encounter the same level of care. That consistency reflects operational maturity and enhances brand trust.

When service optimization and technology intersect, customer loyalty becomes a natural outcome.

Reliability Across Expanding Industries

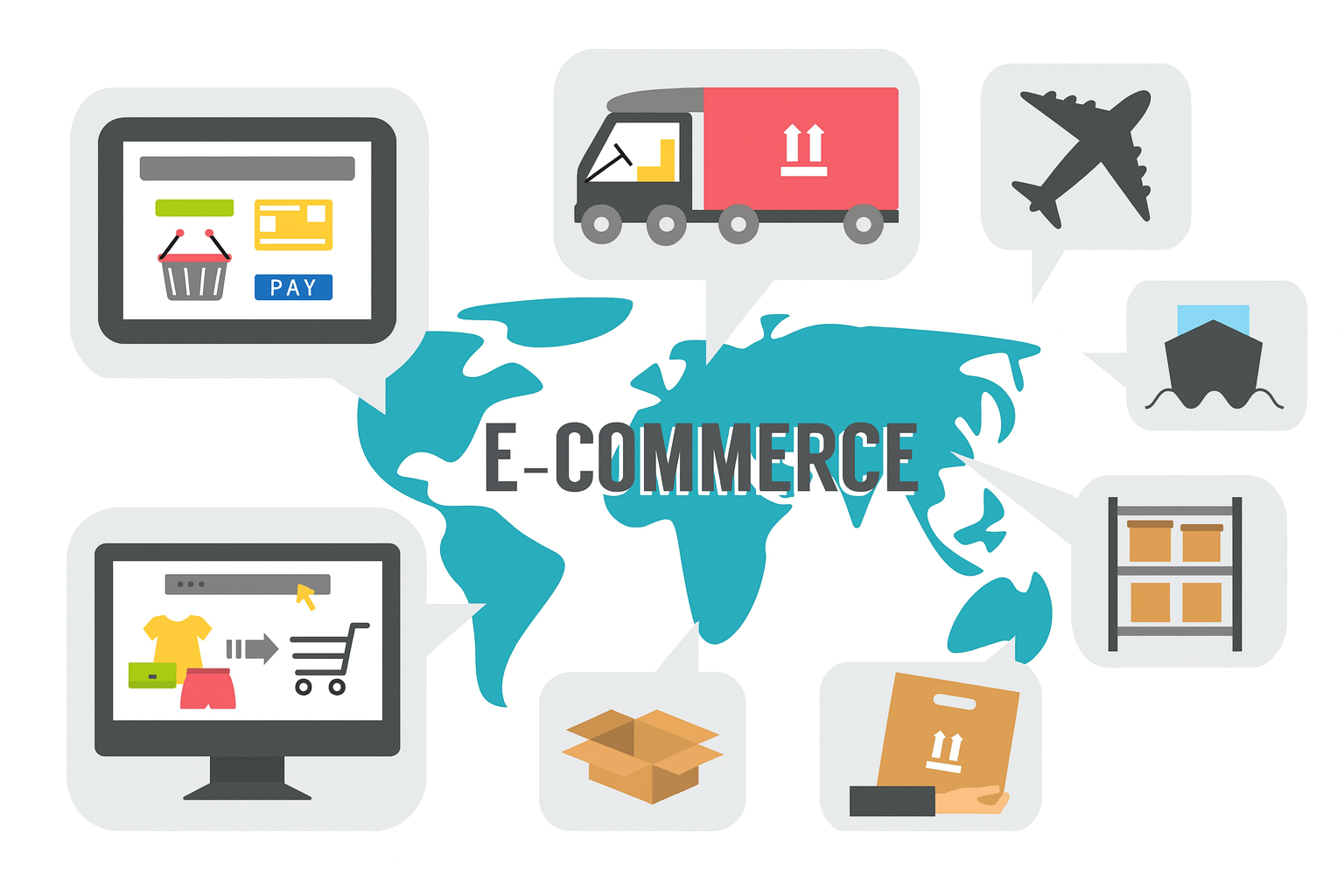

Reliability is the shared foundation across all industries. Each sector, healthcare, finance, retail, and logistics, relies on dependable systems to maintain stability. Without strong performance infrastructure, even small failures can lead to costly interruptions.

Enterprises invest in redundancy, load balancing, and backup systems to ensure continuity. These measures protect against outages and sustain production during high-traffic periods. They also support long-term scalability as organizations grow.

Enterprises invest in redundancy, load balancing, and backup systems to ensure continuity. These measures protect against outages and sustain production during high-traffic periods. They also support long-term scalability as organizations grow.

In retail, infrastructure ensures seamless order management. In finance, it secures sensitive transactions. In logistics, it tracks movement in real time. Despite differences in function, the goal is the same: operational reliability.

Enterprises measure reliability through uptime and response times. The higher the performance consistency, the stronger the reputation. Customers notice when systems work flawlessly, and trust deepens.

The success of infrastructure across industries shows that technology is not just a tool but a necessity. It defines how companies connect with their markets and deliver consistent results.

Building Sustainable Reliability with Expert Systems

Strong enterprise support starts with reliable systems. In a fast-changing digital economy, infrastructure determines how quickly businesses can adapt and how confidently they can grow. Partnering with specialists in performance infrastructure means investing in the strength behind every process.

Organizations like bpomanila help enterprises build structures that combine innovation with discipline. Their expertise ensures that each layer, from IT development to customer engagement, functions in harmony. With scalable systems and advanced monitoring, bpomanila creates frameworks that maintain speed, precision, and dependability.

A performance-based infrastructure does more than support day-to-day work. It drives innovation, improves quality control, and sustains operational reliability. Businesses that prioritize infrastructure now prepare for the challenges of tomorrow.

Let your enterprise grow without limits. Build systems that align with your goals and scale as your vision expands. Our experts create infrastructure designed for endurance, adaptability, and measurable performance. Reach out today to transform your operations into a model of lasting efficiency and stability.

Customer interaction remains the heart of every enterprise. In a world where response speed and personalization matter, process intelligence redefines how organizations deliver customer service.

Customer interaction remains the heart of every enterprise. In a world where response speed and personalization matter, process intelligence redefines how organizations deliver customer service. In FinTech, intelligent systems monitor workflows to improve transaction efficiency and risk control. They enhance verification, automate reporting, and ensure full transparency for every financial interaction. With these systems in place, organizations gain the confidence to scale securely.

In FinTech, intelligent systems monitor workflows to improve transaction efficiency and risk control. They enhance verification, automate reporting, and ensure full transparency for every financial interaction. With these systems in place, organizations gain the confidence to scale securely.

Industries rely on strong networks to thrive and to sustain growth across borders. Each sector is shaped by the way it communicates, collaborates, and connects with new opportunities. A world class base for contact is what allows these

Industries rely on strong networks to thrive and to sustain growth across borders. Each sector is shaped by the way it communicates, collaborates, and connects with new opportunities. A world class base for contact is what allows these  Innovation is the force that shapes modern contact excellence. As expectations continue to rise, companies must design systems that are faster, smarter, and more responsive. Innovation is not limited to advanced technology. It also means discovering new ways to connect with people and create experiences that matter.

Innovation is the force that shapes modern contact excellence. As expectations continue to rise, companies must design systems that are faster, smarter, and more responsive. Innovation is not limited to advanced technology. It also means discovering new ways to connect with people and create experiences that matter. Global services play a vital role in sustaining long-term enterprise growth. Services that can adapt quickly to client requirements help businesses remain competitive in rapidly shifting markets. These

Global services play a vital role in sustaining long-term enterprise growth. Services that can adapt quickly to client requirements help businesses remain competitive in rapidly shifting markets. These

Fintech is transforming financial services with innovative platforms and rapid transactions. As this industry grows, the demand for efficient and transparent debt collection strategies grows as well. Companies need to manage overdue balances while maintaining trust and regulatory compliance.

Fintech is transforming financial services with innovative platforms and rapid transactions. As this industry grows, the demand for efficient and transparent debt collection strategies grows as well. Companies need to manage overdue balances while maintaining trust and regulatory compliance. Data-driven solutions shape the future of debt collection strategies. Predictive analytics, secure databases, and automated workflows support compliance across fintech and healthtech. Organizations use these tools to classify accounts, forecast repayment behavior, and identify risks.

Data-driven solutions shape the future of debt collection strategies. Predictive analytics, secure databases, and automated workflows support compliance across fintech and healthtech. Organizations use these tools to classify accounts, forecast repayment behavior, and identify risks. Partnerships make it easier to innovate. Companies can test new strategies, refine communication methods, and deploy advanced technology faster. This agility improves both customer experience and financial performance. It also frees internal teams to focus on core operations, knowing their collection processes are in capable hands.

Partnerships make it easier to innovate. Companies can test new strategies, refine communication methods, and deploy advanced technology faster. This agility improves both customer experience and financial performance. It also frees internal teams to focus on core operations, knowing their collection processes are in capable hands.