Customer Relationship as the Measure of Quality

Understanding Customer Connection in Every Service

Where does customer service play the part? It begins at the heart of every business function. Service is not a department or a process. It is the emotional and operational bridge that links technology, communication, and satisfaction. Every company relies on it, and every client values it.

In the environment of BPOManila, customer service becomes the common ground across solutions. It gives form to efficiency, meaning to data, and personality to automation. The voice of the customer defines how teams build trust and how companies grow loyalty. Through this, service becomes a reflection of respect, one that connects industries, builds credibility, and sustains brand identity.

Consistency Through Core Services

Customer relationship quality is reinforced by three foundational services: quality assurance, technical support, and live chat. These three sustain the rhythm of interaction in different ways but share one goal, to maintain trust and care.

Quality assurance observes performance, ensuring that standards are not only met but improved with every engagement. Technical support delivers expertise in solving complex issues, often acting as the unseen guardian of customer confidence. Live chat creates immediacy, offering real-time help that enhances satisfaction.

Together, these services create a full-circle experience. They allow teams to blend precision and warmth, creating the consistency customers expect. By balancing structure with flexibility, businesses can meet technical needs while preserving the human touch that defines real quality.

Ensuring Customer Care Never Fades

How can we be sure that customer service is not neglected? The answer lies in how it is managed, measured, and valued. Service cannot survive in isolation. It must be part of every plan, metric, and goal. When organizations view customer service as a shared responsibility rather than a single function, they embed empathy within the entire operation.

At BPOManila, service metrics such as satisfaction scores, first response time, and resolution rates serve as direct reflections of company health. These numbers are not only indicators of performance but reminders of accountability. Regular feedback, active supervision, and open communication keep the customer at the center.

Service is never neglected when it becomes culture. It grows when leaders listen, when agents are trained to connect, and when companies measure quality not only in speed but in sincerity.

Integration Across Global Industries

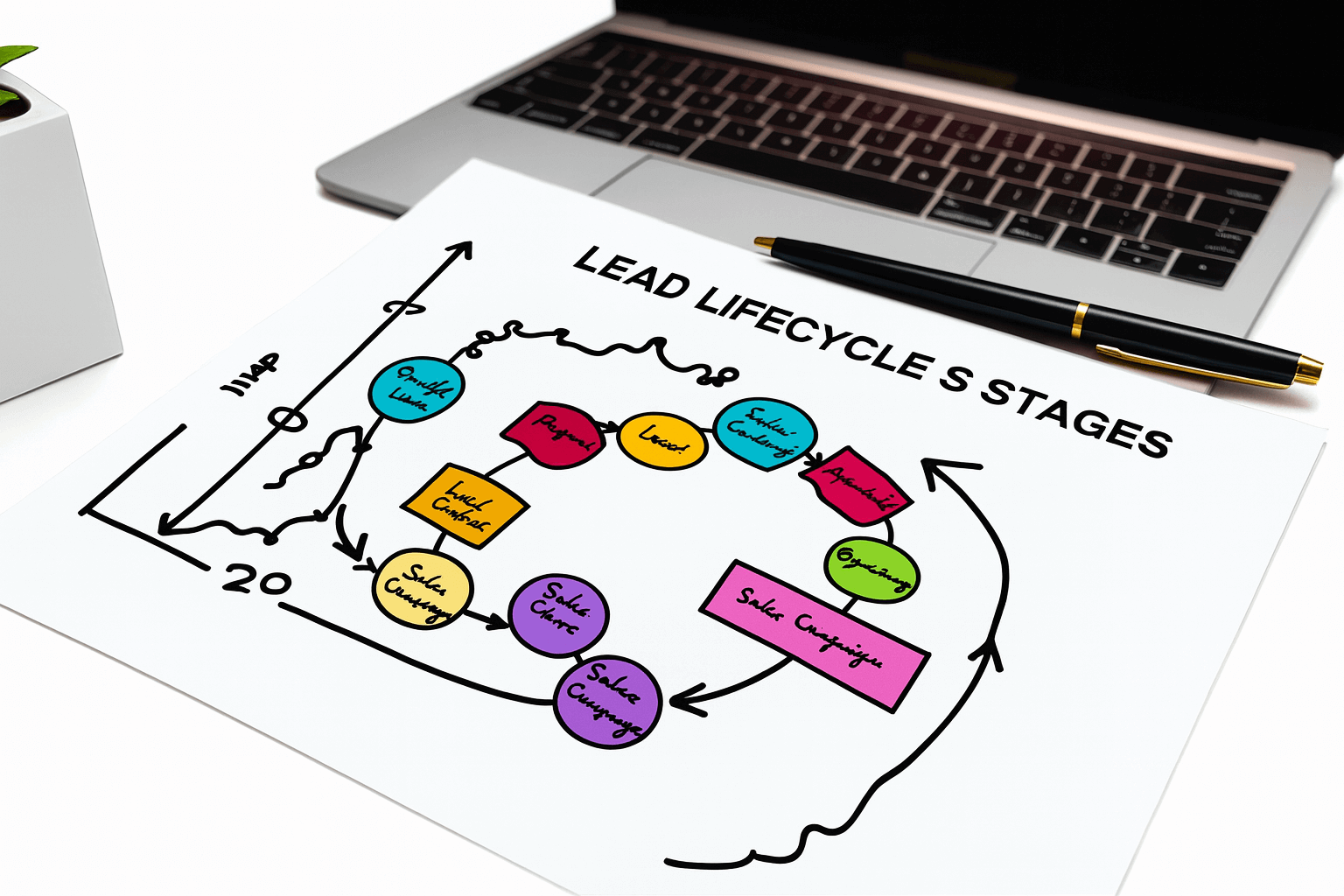

Customer relationship management looks different in every industry, yet its foundation remains the same, connection. In FinTech, accuracy and clarity guide trust. Clients want assurance that their transactions are safe and transparent. In HealthTech, compassion and privacy come first. The smallest act of care can define a lasting bond. In Retail and eCommerce, speed and personalization matter most. Shoppers expect smooth, immediate, and friendly experiences that mirror the convenience of the digital world.

These industries show that service quality adapts, but never weakens. Whether solving a technical issue, processing a claim, or tracking an order, customer connection remains the single element that unites them all.

Prioritizing the Customer in Every Decision

How to make sure that customers are being prioritized? The key is alignment between systems, people, and purpose. Every operational layer should exist to serve the end user. Technology enables this through real-time data and predictive tools, but people sustain it through attention and care.

Customer priority is not only about responding first but about responding right. Listening creates understanding, and understanding shapes improvement. Continuous feedback loops, sentiment analysis, and experience monitoring all ensure that service stays relevant and personal.

At BPOManila, this philosophy builds long-term relationships. The focus is not only on performance but also on empathy, because customers remember how they are treated more than what they are told. Prioritization becomes visible in every positive review, every resolved concern, and every return interaction that signals satisfaction.

Defining Quality Through Human Connection

Customer relationships are not measured in volume but in value. The most successful companies view every contact as an opportunity to strengthen loyalty. Each call, message, and response becomes part of a larger story, the story of a brand that listens and adapts.

When organizations choose to invest in service excellence, they are also investing in people. Agents who understand the meaning of empathy deliver higher satisfaction. Teams that value communication foster trust. It is through human understanding that technical precision finds purpose.

The balance of automation and authenticity defines the next stage of service evolution. As industries become more digital, the brands that thrive will be those that never lose their human connection.

Building Meaningful Partnerships That Last

Quality service does not end with resolution. It continues through relationships that extend beyond the first interaction. Companies grow when they commit to meaningful engagement. Each conversation becomes a chance to add value, and each resolution a reason for customers to stay.

If your business seeks a partner that blends technology, empathy, and measurable results, choose a team that values connection as much as performance.

Begin a partnership that defines quality through genuine relationships. Connect today and experience customer care built on trust, clarity, and purpose.